tax strategies for high income earners 2021

This money is put in the account before taxes lowering your taxable income. It works by setting up a prescribed rate loan.

How To Reduce Your Income Tax Bill Now In One Fell Swoop Ocean Finance

Tax Filing Status.

. Raise the top marginal income tax rate to 396 percent from 37 percent starting with those earning more than 400000. If you are an employee and you have an employer-sponsored 401k or 403b in 2018 you can contribute up to 18500 per year of your gross income. 7 Essential Questions to Ask When Evaluating Financial Advisers Worksheet.

Assuming you qualify the 2021 HSA limits are. 3600 for individuals. Single and head of household filers covered by a workplace retirement plan.

The contribution you will make will come straight out of your. For 2021 the standard deduction is 12550 for single filers and married filing separately 25100 for joint filers and 18800 for head of household. Once that maximum is reached employees can no longer defer earnings toward their 401 k plan.

Pay taxes now at what may ultimately be lower marginal rates than you would be subject to in the future when you make withdrawals. These retirement accounts use pre-tax money so you can deduct. Ad Tax Advisory Services with Dedicated Tax Consultants and a Flexible Suite of Services.

This can help you build tax-free wealth for your future needs or for your heirs to inherit. Ad Make Tax-Smart Investing Part of Your Tax Planning. Build an Effective Tax and Finance Function with a Range of Transformative Services.

There are only so many pre-tax avenues to retirement income. When you invest in an RRSP the amount of your contribution is deducted from your taxable income thereby reducing your tax bill. In general the more you can save in a retirement vehicle up to the allowable limits the more you can usually save long-term on taxes.

Connect With a Fidelity Advisor Today. Employees can defer compensation to their 401 k plan throughout the year until their year-to-date earnings reach 280000. Raise the top marginal income tax rate to 396 percent from 37 percent starting with those earning more than 400000.

The top rate for 2021 applies to individuals earning more than 523600 or more than 628300 for married couples filing jointly. If youre saving on behalf of a family youll need a deductible of 2800 or more with an out-of-pocket maximum of 14000. Despite the increases of the standard deduction limits in recent years it may still make sense for high earners to forgo the standard deduction and opt for itemized deductions.

Here are 50 tax strategies that can be employed to reduce taxes for high income earners. For example the 2021 contribution limit for 401 k plans is 19500 meaning you can lower your taxable income by up to 19500 if you max out these deferrals. As a high earner your 401 k will likely offer the highest contribution cap for tax-deferred retirement savings - making it an important.

The top rate for 2021 applies to individuals earning more than 523600 or more than 628300 for married couples filing jointly. 50 Best Ways to Reduce Taxes for High Income Earners. In addition to offering you an opportunity to help your favorite cause donating to.

You can use the money to pay for medical and dental expenses including some over-the-counter medicines. High earners who want to put more dollars aside must find alternatives beyond such traditional means as 401ks and IRAs. Married filing jointly.

We all know that wage income earners pay a higher percentage of their income in taxes compared to those people who have invested their wealth. Of course the first step in saving for retirement is to maximize those plans contribute to the maximum allowable limit. This is one of the most basic tax strategies for high income earnersthat you can take advantage of.

The highest income earner pays 37 of his or her income in federal income tax while the highest tax rate for long-term capital gains is 20. Potential changes coming up the legislative pipeline could also. Family Income Splitting and Family Trusts.

Take advantage of the lower rates under the Tax Cuts and Jobs Act before they sunset in 2025. Learn to ask if you have the right financial plan in place for your 500k portfolio. Specifically contribute to a traditional 401k or IRA.

Here Are the Tax Deductions for High-Income Earners That You Can Claim in 2022 Charitable contributions deductions. Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account. You are allowed to put in 3600 per individual per year and 7200 for families in 2021 and 3650 and 7300 for families in 2022.

Tax Strategies For High Income Earners Pillar Wealth Management

Why Do Some Investors Pay More Tax Than Others

Why The Coronavirus Did Not Bring The Financial Rout That Many States Feared The New York Times

Percentages Of U S Households That Paid No Income Tax By Income Level 2021 Statista

Here S How Rising Inflation May Affect Your 2021 Tax Bill

Irmaa 2021 High Income Retirees Avoid The Cliff Fiphysician Com Higher Income Income Paying Taxes

Personal Tax Budget 2022 Taxing Times Kpmg Ireland

Build Back Better 2 0 Still Raises Taxes For High Income Households And Reduces Them For Others

How To Reduce Your Income Tax Bill Now In One Fell Swoop Ocean Finance

Changed Income Tax Regime Needed If We Are To Continue Attracting Talent

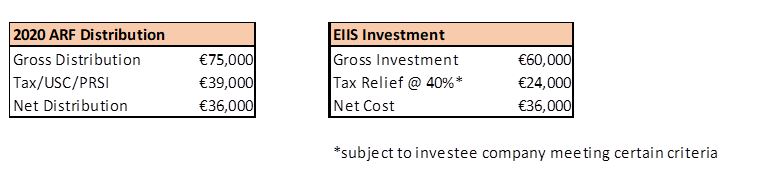

Eiis In Arf Pension Tax Efficient Investment Options

Eiis In Arf Pension Tax Efficient Investment Options

France Cryptocurrency Tax Guide 2021 Koinly

Pin By Niina Felushko On Financial Matters Senior Discounts Efile Tax Return

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)