do you pay taxes on a leased car in texas

Instead sales tax will be added to each monthly lease. A leasing companys income.

Nj Car Sales Tax Everything You Need To Know

Do I owe tax if I bring a leased motor vehicle into Texas from another state.

. Does that mean you have to pay property tax on a leased vehicle. In the state of Texas any leases lasting for greater than one hundred and eighty days are considered to be exempt from the general sales and use tax but will be subject to any motor. The lessee does not have to pay any property taxes on the vehicle.

In other states such as Illinois. When the vehicle is purchased and titled in. Instead you can pay your sales tax over the term of your lease.

If youre leasing a car as a private individual through a personal lease you will be required to pay VAT value-added tax at a fixed rate of 20. When youre leasing a car you dont have to pay sales tax upfront. Even if you refinanced it at UFCU down the street youd have to pay taxes.

Most states incorporate sales tax into the monthly car rental payment although some states require that the full sales tax on all your rental payments be paid in advance. Even if you bought it back from Audi youd still have to pay taxes. Do I have to pay taxes on a leased car.

In some states such as Georgia you pay a title ad valorem tax up front on the capitalized lease cost or lease price see Georgia Car Lease for recent changes. When a vehicle is leased in another state and the lessee brings it to Texas. Unless exempt by state law or federal law all property in Texas is taxable.

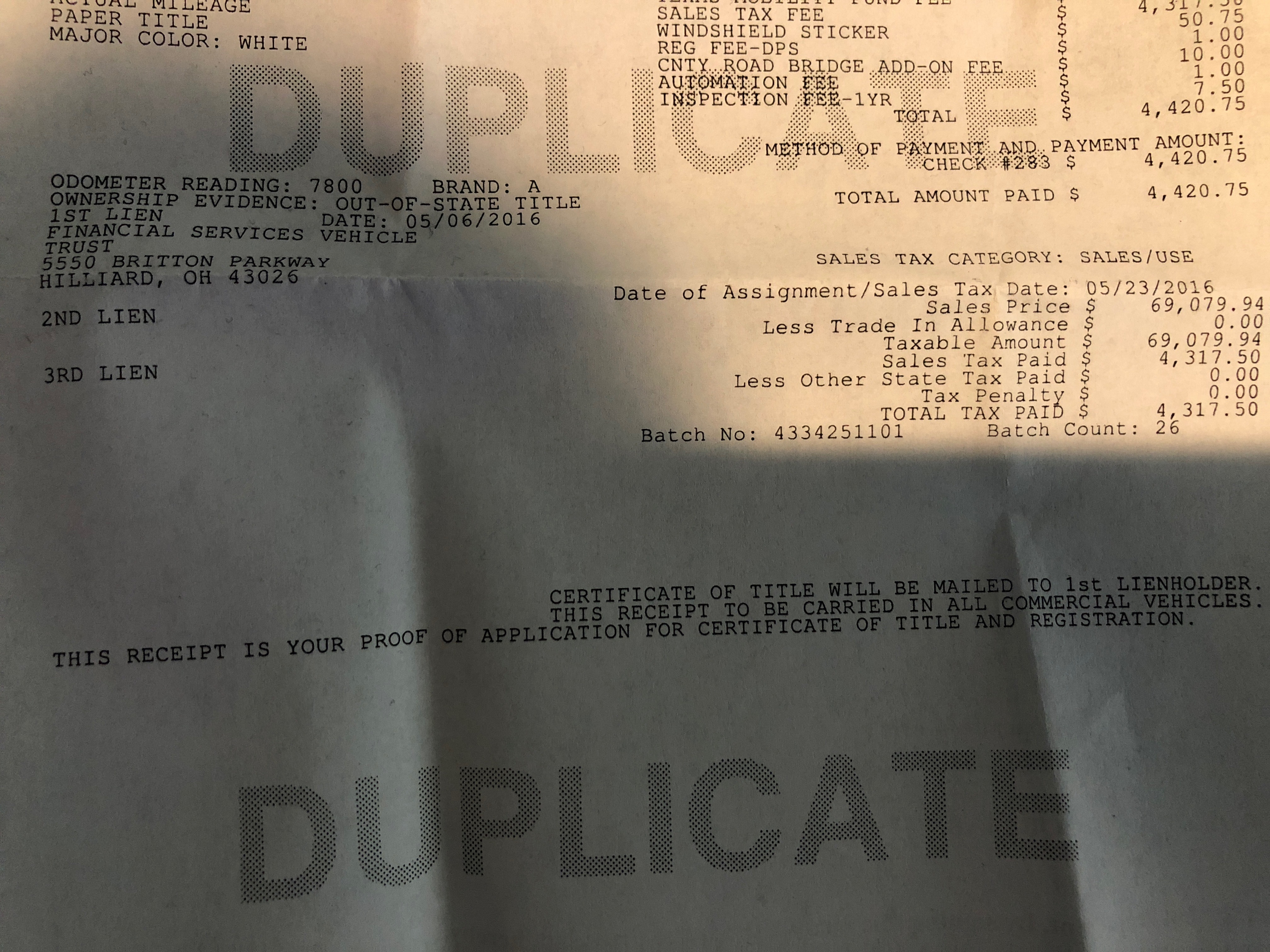

The lease contract is not subject to tax. Yes you absolutely have to pay taxes. In Texas lessees of a motor vehicle purchasing it for lease do not owe any sales tax.

No tax is due on the lease payments made by the lessee under a lease agreement. Any tax paid by the. There are a couple of other options to minimise this if you plan to own the vehicle.

All leased vehicles with a garaging address in Texas are subject to property taxes. In Texas all property is considered taxable unless it is exempt by state or federal law. The monthly rental payments will include this.

Yup you pay the tax twice unfortunately or just once if you had tax credits for the initial lease. Technically there are two separate transactions and Texas taxes it that way. Also no tax is due by the lessee on the purchase of a motor vehicle for lease in Texas.

When you lease a car in most states you do not pay sales tax on the price or value of the car. This means that you will have to pay taxes on your leased car. There are some available advantages to leasing a vehicle in a business name please.

In Texas leases of vehicles are not taxable. Yes in Texas you must pay tax again when you buy your off-lease vehicle. Motor vehicle tax is payable by the renter at the time of title and registration upon purchase of the motor vehicle from the lessor because a new taxable sale second.

How Much Is A Tesla Lease In 2022 Electrek

What To Do At The End Of A Car Lease Yaa

Do You Pay Sales Tax On A Lease Buyout Bankrate

Property Tax On A Leased Vehicle O Connor Property Tax Experts

Car Insurance When Leasing Vs Buying Direct Auto Insurance

What Should I Expect When I Return My Leased Car Autotrader

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Leasing A Car How To Do It Mistakes To Avoid Bankrate

Lease Assumption In Texas From An Out Of State Lease Taxes Ask The Hackrs Forum Leasehackr

Taxes On A Lease Transfer Ask The Hackrs Forum Leasehackr

Hyundai Lease Return Center In Houston North Freeway Hyundai

Can You Move Out Of State With A Leased Car Moving Tips

Totaled A Leased Car Everything You Need To Know Stoy Law Group

Bmw 8 Series Lease Incentives Prices Austin Tx

Sales Taxes Demystified Your Car Lease Payments Explained Capital Motor Cars

Buy Or Lease Serves Houston Fred Haas Toyota World

Move Your Leased Car Out Of State Blog D M Auto Leasing